Sugar spent the week consolidating within a narrow 90-point interval, with a 20.44 cent per pound high and a 19.54 cent per pound low, closing the week just at a 6-point high against last week. October/2016 closed Friday at 19.77 cents per pound. The weakened October/March spread shows that demand on the physical is still boringly anemic.

On the other hand, Brazilian sugar exports reached 2.9 million tons in July driving the twelve-month accumulated up to 26.75 million tons (from August/2015 to July/2016), over 10.4% for the same period last year. The accumulated in the harvest year (from April to August) comes up to 9.1 million tons, the largest volume in this decade.

Some traders argue that October/March spread weakness was due to the rolling of the long positions of the funds for March. On rolling them, they pressured October (which they are selling) and boosted March (which they are buying), making the spread widen. It is an argument. The two billion dollar question is – since this is the approximate gain value the funds are getting – why the funds rolled a long position bringing 50 points of loss into their portfolios instead of liquidating it and pocketing all this huge amount of money they are making?

The world financial market has more than a dozen trillion dollars invested on negative interest rates. It’s a tough task for an investor to put in money to have a 1% per year profitability (just double the capital, in thesis, every 70 years), while risk assets which yield at least 5% have already decreased this gloomy “wait” by 56 years. This must be one of the reasons the funds have kept a 323,000-lot position – they believe the market will continue to rise.

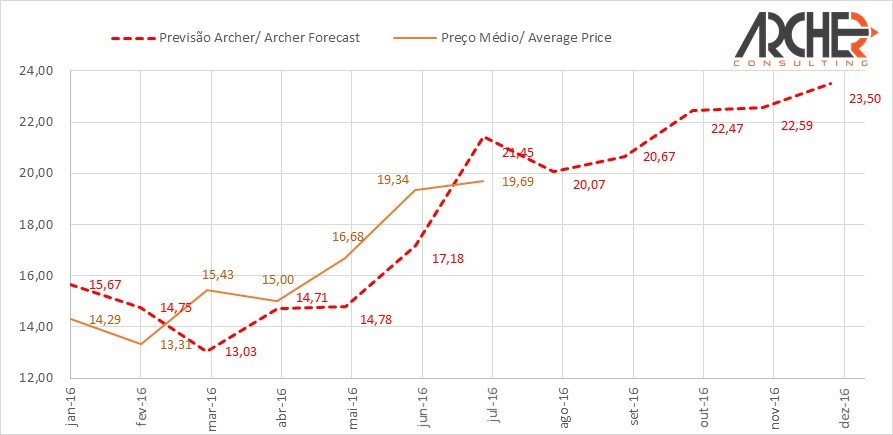

The model of price forecast by Archer Consulting shows that we might have average sugar prices (closing of the first trading month) in NY at 20.67 cents per pound for September, 22.47 cents per pound for October, 22.59 cents per pound for November and 23.50 cents per pound for December. It is always worth remembering that models are faulty. However, look at the graph and compare the forecast (dotted line) to the effective value (solid line).

Looking at the fundamentals and exogenous factors which can be considered bullish and bearish, it’s been much more difficult to find the latter. What can drive this market down? We have already seen that the market has a solid support at about 18.50 cents per pound and besides industrial consumers say they are worried about the sugar price hike and the decrease in their product margin. Selling 18.50 cent per pound puts along the curve has been a good opportunity to decrease acquisition cost. As we commented here recently, oil price is the most valuable factor we see as a possible effect of sugar price destabilization. If it falls below 40 dollars per barrel, it will take sugar along with it. The American interest rate high, the low demand on the export market, an eventual “monstrous” delivery against October/2016 six weeks from now and the patience depletion of the funds in hopes of higher prices can be ingredients for a huge liquidation. But who believes in the Big Bad Wolf?

The second pricing estimate of the mills on the NY futures market for the 2017/2018 harvest shows, according to the model developed by Archer Consulting, that up until late July/2016, 4.28 million tons had already been fixed (16.1% of the estimated export). The calculated average price was 16.25 cents per pound. We have no elements to compare this volume to that of previous harvests because there has never been such pricing anticipation like now. Just to get an idea, this percentage of 16.1% was only reached between August and September of previous harvests (since 2012/2013 when we started monitoring). The average adjusted value of pricing, taking into account the NDFs (non-deliverable forward) points to R$1,499.89 per ton, or 65.29 real per pound.

How about ethanol, huh? Our supply and demand simulation for Brazil shows we will have an extremely tight off season for ethanol. The current hydrous price put into equivalency with sugar in NY shows a 500-point discount, that is, 14.71 cents per pound. Does anyone think this discount will last? Wouldn’t buying ethanol at the BM&F Bovespa and selling sugar in NY be a good strategy for the last quarter of the year?

If you still do not have the book “Agricultural Derivatives” (Portuguese only)- I wrote together with journalist Carlos Raíces – you can download it for free by clicking on https://archerconsulting.com.br/livro/

There are still spots for the 26th Intensive Course on Futures, Options and Agricultural Derivatives to be held on September 27, 28 and 29, 2016 from 9:00 am to 5:00 pm in São Paulo, SP. For further information contact priscilla@archerconsulting.com.br

If you want to get our weekly comment on sugar straight through your email, just register at our site by logging onto https://archerconsulting.com.br/cadastro/

Have a nice weekend.

Arnaldo Luiz Corrêa