The sugar futures market in NY has had a week of strong high. The close of March/2016 on Friday hit 15.48 cents a pound (after having traded at up to 15.85 cents per pound), representing a 50-point increase against last week, that is, over 11 dollars a ton. The maturities for the 2016/2017 Center-South crop at the exchange, from May 2016 to March 2017, showed average positive variations of 8-9 dollars a ton. The next one (2017/2018) has been put aside.

The funds have kept a position which holds the market at the current levels. There are 212,000 long contacts which are equivalent to 10.8 million tons of sugar. However, I believe that the addition of more purchases beyond this volume might set a limit to the movement of funds. In other words, the market can eventually turn heavy. The huge volume of open puts (put options) maturing in January (between the exercise prices of 14.00 and 15.50 cents per pound) should add up to 16,000 contracts.

What’s encouraging for the physical market which has been put aside and doesn’t show anything new is that the spread (March/May) is still strong closing at 46 points. The spread is usually the thermometer which foresees on the futures market what will probably happen on the physical market. For the time being, everything leads us to believe that the fundamentals will prevail.

Price forecasting in NY based on the model developed by Archer Consulting, which takes into account the average prices for each month over the last fifteen years and their correlation to pricing formation for the following months, shows that the average price for December should be 8% better than that for November. In January, it should be 4% better than that for December. February would reach the price peak followed by March with a slight drop. We are talking about average price, not maximum price.

The real devaluation against the dollar and the detachment of the sugar market in NY from the exchange rate have encouraged the mills to lock their prices which have also reached a record. After the sugar contract in NY detached itself from the dollar fluctuations, there was an amazing unprecedented increase in the pricing of export sugar contracts by the mills. The fourth estimate for the fixed volume for the 2016/2017 harvest determined by the model developed by Archer Consulting shows a total of 13.174 million tons of sugar at an average price of 13.57 cents a pound, or its equivalent in R$1,172 an FOB ton. This volume should represent a 55.75% fixation of the harvest, considering Archer’s estimate for a Brazilian export volume of sugar of about 25.12 million tons. The average dollar obtained by the mills is R$3.7639. The model estimates a plus or minus 3.74% error on the determined price. Compared with the last four harvests, the accumulated percentage of 55.75% fixation for 2016/2017 is the highest ever seen. Last year, for instance, the accumulated over this same period of time was only 23.23%.

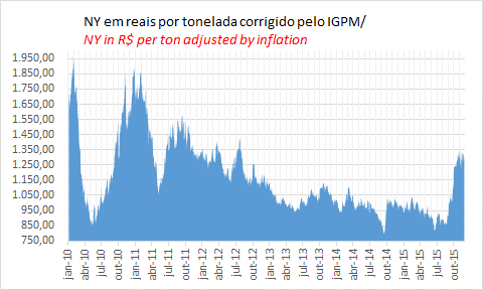

See graph on daily closing of the sugar futures market in NY (first quotation) converted into R$/ton, by the Central Bank exchange rate and adjusted by the IGPM (Inflation). The highest adjusted price over the analyzed period (from January 2010 up to now) has been R$1,964,58 a ton on January 29, 2010. This value would be obtained today considering the real at 3.8500 and NY trading at 22.25 cents a pound. The lowest adjusted price has been R$789.59 a ton (equivalent to NY at 8.94 cents a ton today) on September 16, 2014.

In nominal values the mills have been getting the highest price in real per ton since February 2011. Price over R$1,300 FOB equivalent with polarization premium is extremely profitable. That’s why so many people are starting to make calculations to fix for the 2017/2018 crop as well. Look, the well-capitalized and professionally risk-managed companies which can make an NDF (non-deliverable forward) for 2017 and fix futures for the same period might be able to get a fixation on sugar equivalent to R$1,500 a ton.

If the political situation doesn’t change and the average dollar for 2017 is R$4.0000, the average sugar quotation in NY has to be at 16.35 cents a pound so that the same R$1.500 a ton can be obtained, that is, it has to go up 200 points. If the political scenario improves and the dollar stays at R$3.5000 on average, NY will have to trade at 18.70 cents a pound to break even based on what we can fix under today’s conditions, that is, a 440-point increase.

If the company still doesn’t feel secure with R$1.500, it can make some operations using derivatives to take advantage of a possible price increase in dollars.

Put it on your 2016 calendar. The Night Course on Options will take place on February 22, 23, 24 and 25 , and the XXV Intensive Course on Futures, Options and Derivatives in Agricultural Commodities will be held on March 29, 30 and 31 in São Paulo.

If you would like to get our weekly sugar comments straight through your email, just register at our site by linking to https://archerconsulting.com.br/?lang=en.

Have a nice weekend everybody.

Arnaldo Luiz Corrêa